EC334 Assessed Problem set (2024)

The assignment is due 1400 on 02/04/2024 by pdf online submission You may scan handwritten equations, provided that they are legible. Define all variables and clearly explain the steps in any calculations or derivations.

Please complete both problems.

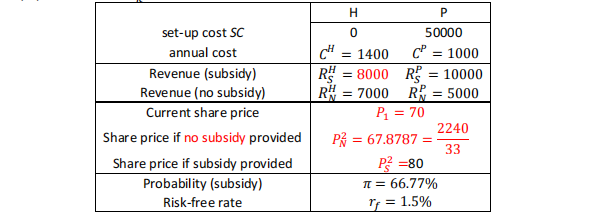

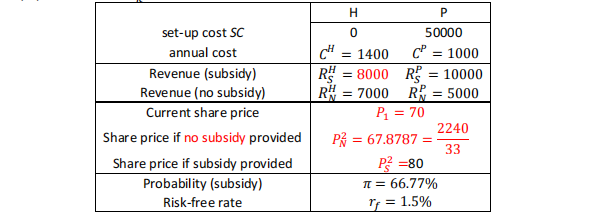

1. A firm produces electrically-assisted e-bikes. Currently, it produces a hybrid (“H”) model, which recharges the battery using the cyclist’s peddling energy. It has recently developed plans to switch to producing a plug-in (“P”) model whose battery must be charged from an EV charging socket. The firm is aware that the government is thinking about subsidising

enhancements to the UK’s charging infrastructure, which would increase demand for the P model – this decision will be taken at the beginning of year 2, will take effect immediately

and cannot be reversed. Currently, the firm estimates the associated costs and revenues as shown in the following Table. Annual costs for the H and P technologies are denoted

𝐶

𝐻

or 𝐶

𝑃

; revenues from model 𝑖 ∈ {𝐻, 𝑃} in state 𝑘 ∈ {𝑆, 𝑁} for Subsidy (𝑆) or No Subsidy (𝑁) are denoted 𝑅𝑘𝑖

.

If the firm switches to the plug-in (P) model now, the new facility will not come onstream till next year; this year, the firm will pay the set-up cost 𝑆𝐶 and the annual cost 𝐶

𝐻 of

producing the existing Hybrid (H) model and get revenues 𝑅𝑁𝐻. From next period onwards, the firm will pay annual cost 𝐶

𝑃

and get the relevant revenues (depending on the

government’s decision regarding the subsidy policy).

The firm’s share price is correlated with the government decision as shown in the above table. After next period, the firm continues producing the chosen model (H or P) forever.

a. If the firm decides this year (before the government decision is known), what are the NPVs for the firm if i) it stays with H or ii) it switches to P, using the

riskless rate for discounting? Which would the firm choose? [10 marks]

b. Using the share price, compute the WACC corresponding to sticking with the H model. Using this for discounting, what are the NPVs for each model and which

would the firm prefer? [15 marks]

c. Using the WACC computed in part b, how much would the company be willing to pay for an option to delay the model choice until next year, once the government’s subsidy decision is known (assume the setup cost is paid when the decision is taken, one period before the new revenue stream starts)? [25 marks]

my wechat:_0206girl

Don't hesitate to contact me